The real-world numbers, from numerous businesses, show just how Ramp can save you time and reduce costs, while also improving the overall visibility of your finance team.

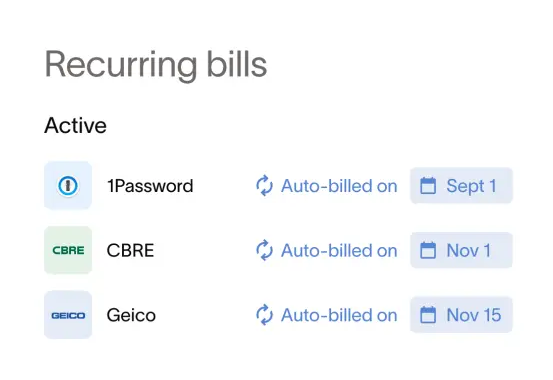

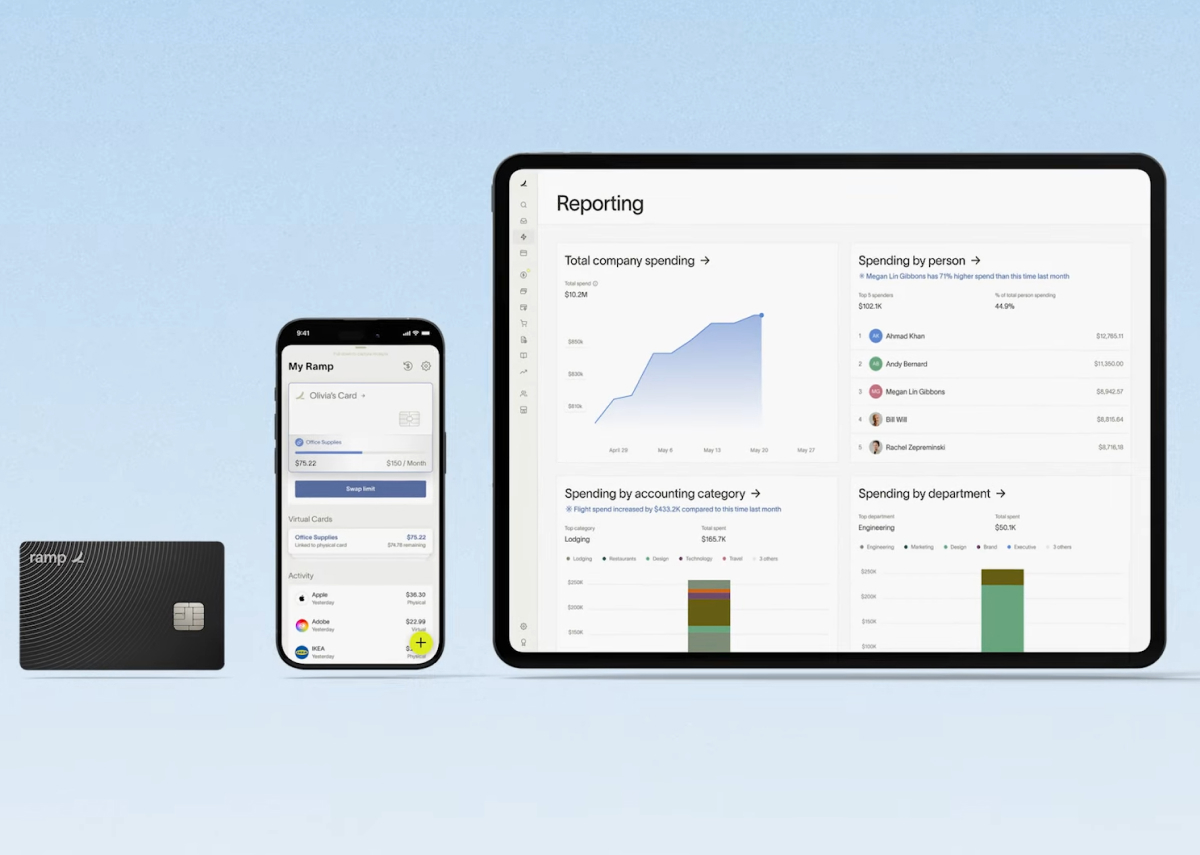

Ramp offers your business efficient, built-in tools for managing company cards, bills, and approvals, all in one place.

Issue unlimited virtual and physical cards with merchant and category restrictions, and earn 1.5% cash back automatically on all spending.

Eliminate manual reporting by giving employees freedom to upload receipts via mobile, and allowing Ramp to match, categorize, and post transactions.

Upload vendor invoices, set approvals, and pay by ACH or check as Ramp syncs each transaction to your specific accounting software.

With TydeCo™ knowhow, Ramp seamlessly connects to Sage Intacct, Xero, and QuickBooks, allowing transactions, categories, and receipts to flow directly into your general ledger.

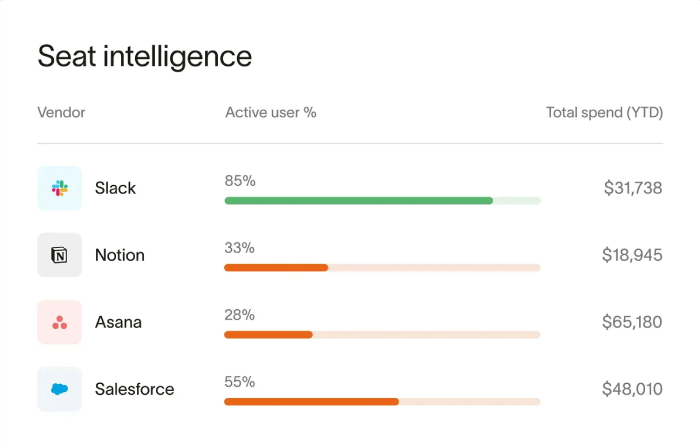

Custom alerts instantly notify your finance managers of any policy breaches, duplicate subscriptions, or overspending, before month-end.

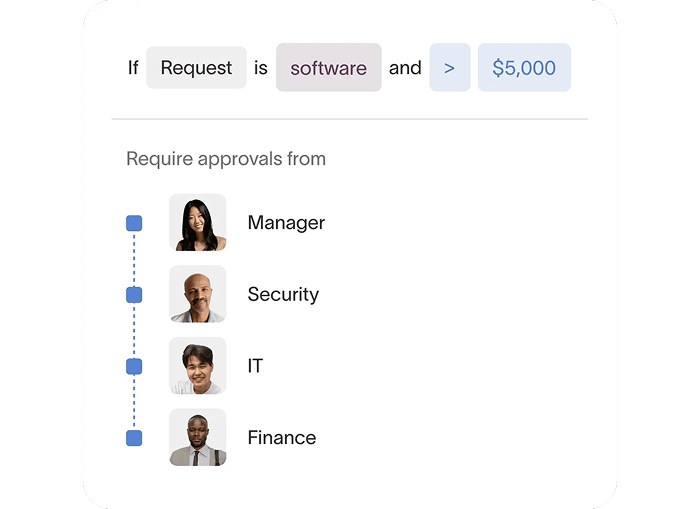

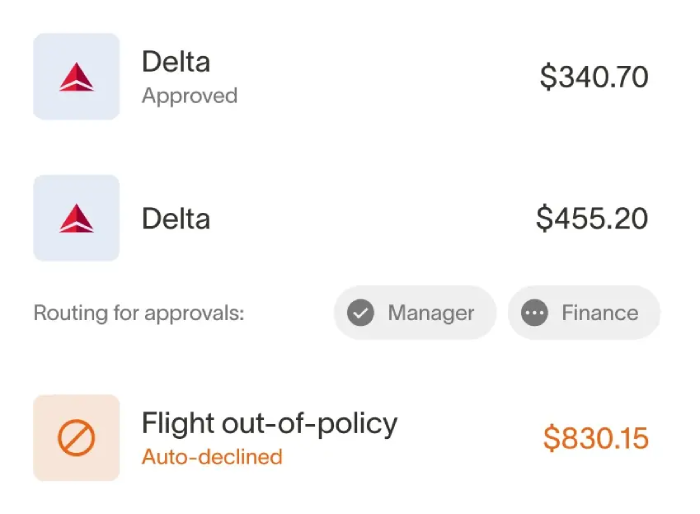

With built-in approval workflows, enable your staff to easily book flights or submit purchase requests directly within Ramp.

Ramp can intuitively highlight duplicate vendors and thus offer lower-cost alternatives, helping teams to save proactively rather than reactively.

With Ramp, TydeCo™ helps companies readily implement advanced workflows that can simplify their finance operations and enforce accountability.

Ramp made it easy for Webflow to scale its remote-first team, automate spend controls, and onboard globally in one day.

Ramp has saved us 75% of our time on credit card reconciliation. It’s intuitive, easy to onboard, and gives us visibility and control—even as a global, remote-first team. It’s one of those key tools that makes new employees feel like they belong from day one.

Xero appeals to service-focused businesses that value clean design, remote collaboration, and smart accounting foundations.

See how Ramp automates spend, procurement, and accounting, helping finance teams move faster and work smarter.

We’re proud to support the teams behind these logos. Long-term partnerships built on trust, capability, and results that hold up.

Ramp works best in industries where real-time spend visibility and control across departments and cards is a daily need. TydeCo™ supports smarter setup and oversight.

Explore our latest thinking on financial systems, reporting strategy, and digital transformation—tailored to the industries and tools we support.

Just getting started or fine-tuning your setup?

Here are a few questions that often come up along the way.

Ramp is a comprehensive AP tool that includes corporate cards, expense tracking, and bill payments in one platform. There’s no need to struggle with spreadsheets and manual reconciliations and expense reports. Ramp focuses on automation and provides real-time expense data, so you can catch overspending immediately.

Ramp is quick and easy to set up, with the typical turnaround time being 4-6 weeks. We manage the full implementation process, including accounting integration, card policy setup, and workflow configuration. What’s more, we provide team training and ensure that there is virtually no disruption to your finance operations.

Yes. Ramp integrates with Sage Intacct, Xero, and QuickBooks Online. It automatically syncs expenses and card transactions to your general ledger. Reconciliation and financial reporting are automated and streamlined. It’s our job to ensure accurate mapping to General Ledger codes and vendor records. Automation reduces manual entries and increases accuracy.

We are a certified Ramp Professional Services Partner, implementing Ramp for clients who use QuickBooks, Intacct, and Xero. Not only do we manage setup, integrations, approval policies, and team training, but we also provide post-launch support and optimization. We’re there at the beginning, ensuring that your finance system is correctly configured and efficient from the get-go.