These stats show just how FloQast can help finance teams close their books faster and eliminate risk, improving overall confidence across the organization.

From automated reconciliations to advanced workflow visibility, TydeCo trusts FloQast to equip your finance team with real operational control.

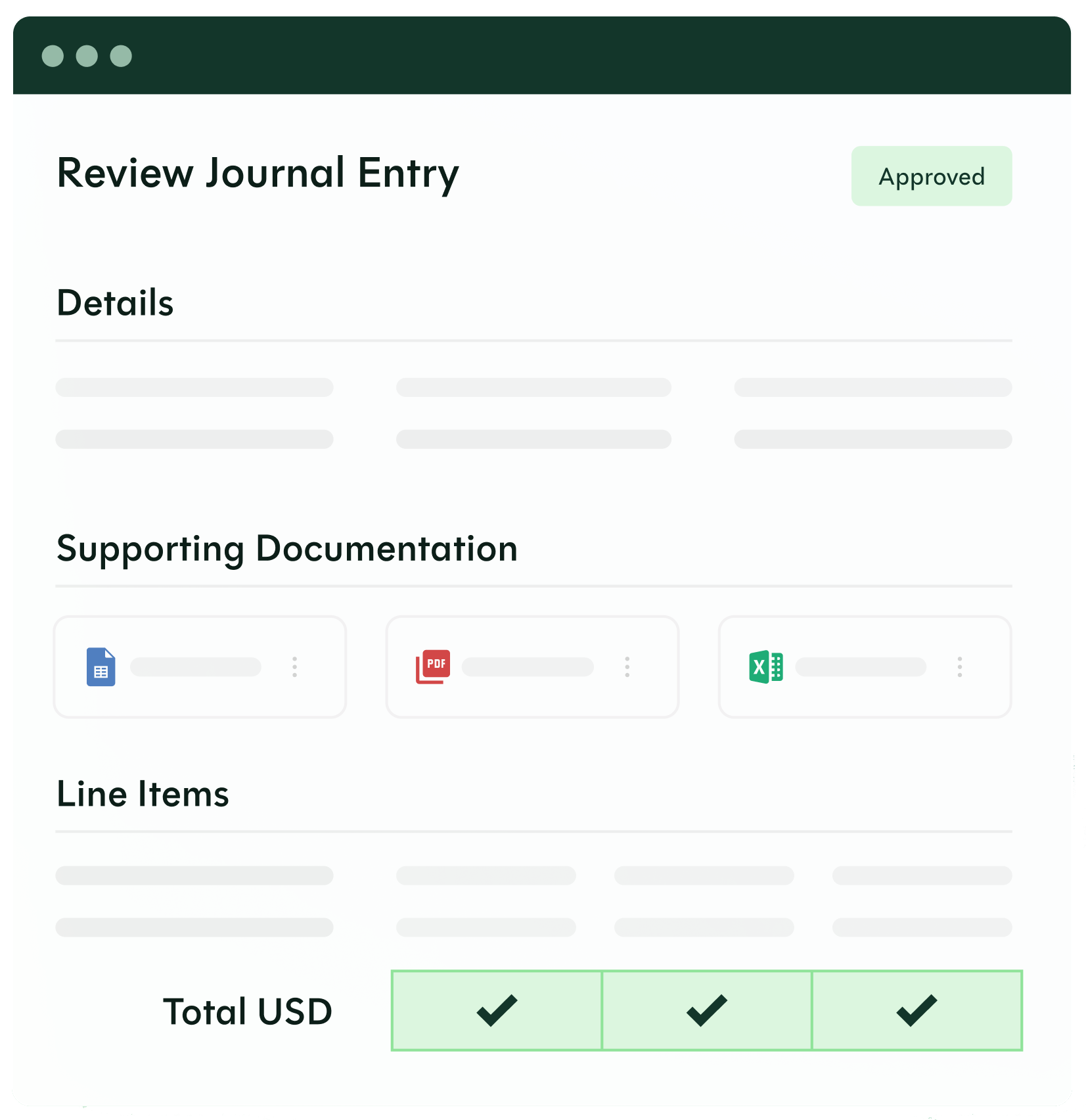

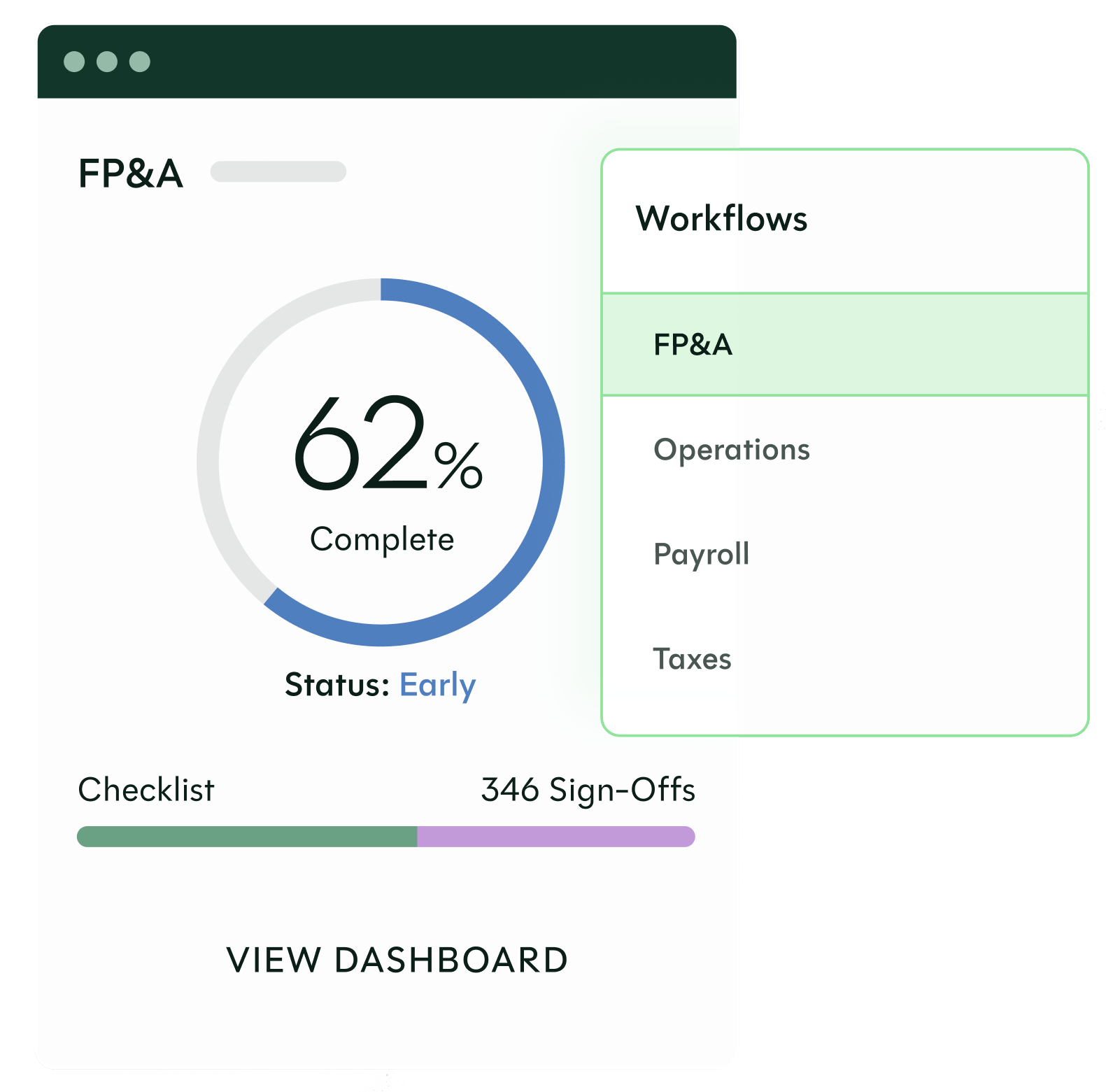

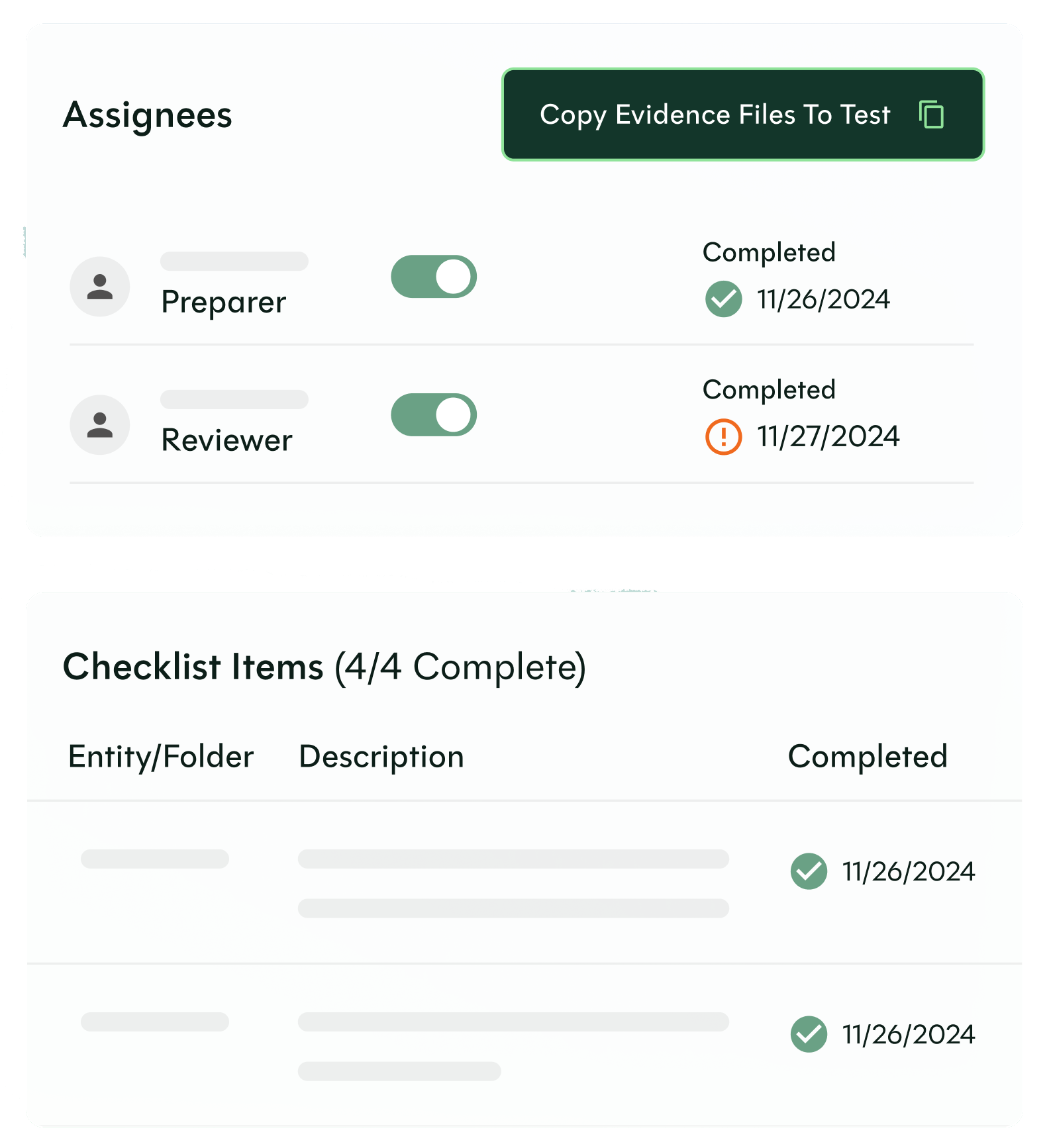

Centralize and streamline your close process with task assigning and deadline automation, along with full visibility across your finance team.

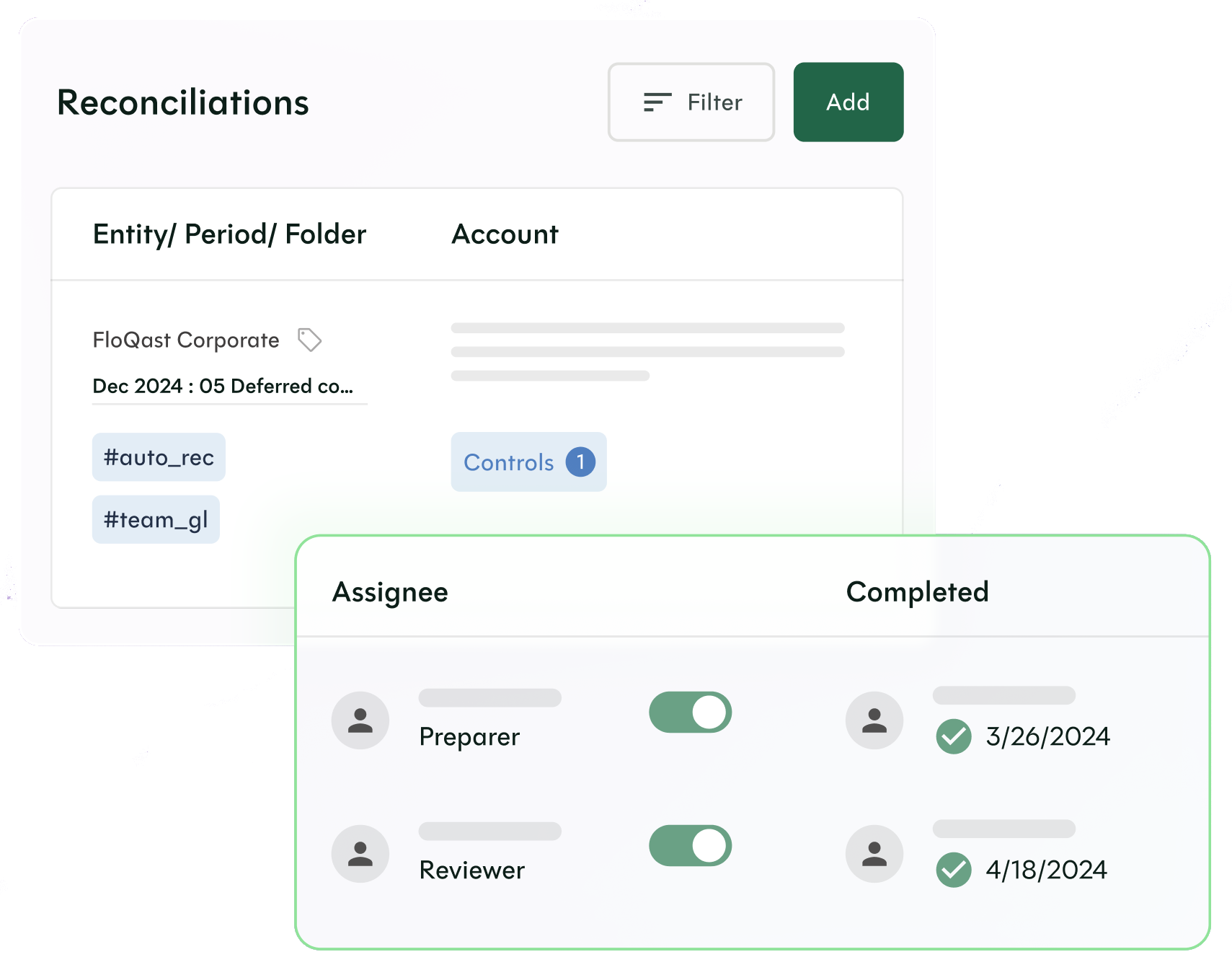

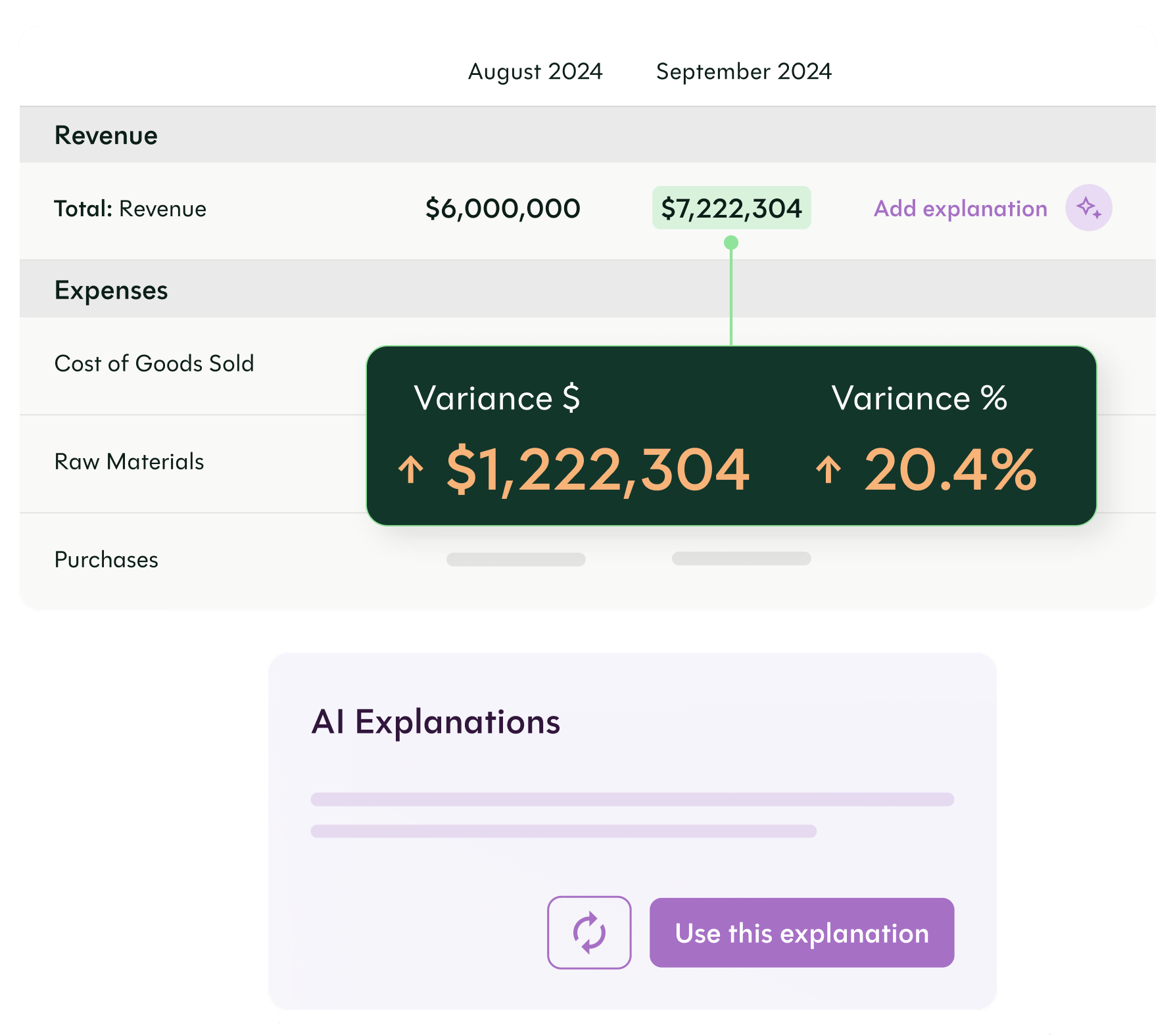

Reduce the manual workload with automated reconciliations that pull data directly from your ERP, making it easy to detect discrepancies early.

Maintain an always-ready audit trail with real-time documentation, workflow logs, and version histories built directly into your close tasks.

Keep everyone perfectly aligned with automated reminders and shared templates, providing a single source of truth for all close-related activities.

Use standardized close checklists that ensure nothing falls through the cracks, while allowing for easy customization as your needs evolve.

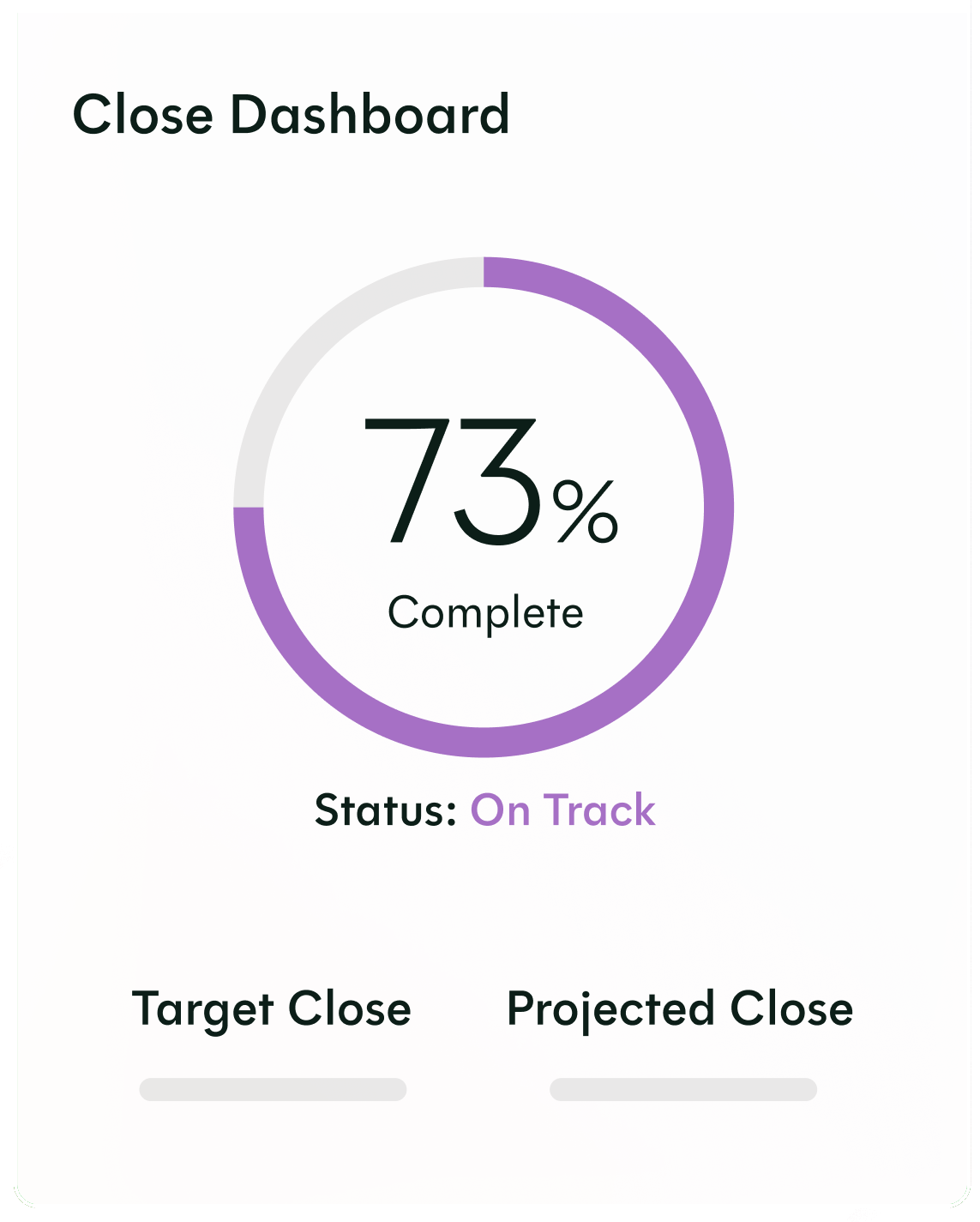

Get better visibility into team performance, bottlenecks, and task completion metrics so that you can optimize financial processes and demonstrate actual progress.

FloQast integrates natively with Sage Intacct and other leading ERPs, pulling GL balances directly to reduce data entry errors and time wastage.

Unlock additional value with extended software tools and add-ons designed to deepen insight and streamline controls while also scaling effortlessly.

Before FloQast, Centogene juggled spreadsheets and email. Now, close and compliance live in one transparent, easy-to-use system.

We wanted one tool for our timetable, documentation flow, and a shared solution for auditors. With FloQast, we finally found it. It connects close management and SOX compliance in one place, which makes everything visible and easy to understand. Having one source of truth reduces effort and brings transparency across teams.

FloQast is designed for finance teams that want structure without sacrificing flexibility—especially during the month-end close.

See how FloQast helps controllers and CFOs streamline close, improve accuracy, and gain visibility in real time.

We’re proud to support the teams behind these logos. Long-term partnerships built on trust, capability, and results that hold up.

FloQast is a strong fit for teams in fast-moving industries where financial controls, approvals, and audit timelines matter. TydeCo™ supports implementation and scale.

Explore our latest thinking on financial systems, reporting strategy, and digital transformation—tailored to the industries and tools we support.

Just getting started or fine-tuning your setup?

Here are a few questions that often come up along the way.

We take on a range of services, from discovery and workflow mapping to the full implementation of solutions. You can get on with the business of doing business while we configure integrations with your ERP and other systems, ensuring everything aligns with your team’s internal close processes.

FloQast provides pretty specific solutions, mainly related to close management services. It integrates with existing accounting systems, ensuring your monthly close processes are accurate, efficient, and easy to report. We typically use FloQast for outsourced controller services, CFO reporting and oversight services, and system integration and automation.

Yes, one of our essential services related to FloQast integration is adapting the system to suit multi-entity and high-volume finance teams. With this in mind, we set up custom task lists and role-based dashboards. What’s more, we ensure your team is thoroughly trained to easily manage and scale FloQast solutions.

We have extensive experience in ERP-finance integration. Our deep knowledge underlines our proven success with high-growth finance teams. FloQast is built by accountants for accountants. Our industry-specific accounting specialists use the FloQast system to improve the entire close process; while ensuring you enjoy a healthy work-life balance.