QuickBooks Online delivers measurable results. These key statistics show precisely how the software boosts efficiency, saves time, and improves overall business performance.

From invoicing to real-time reporting, TydeCo utilizes these powerful QuickBooks features to simplify your everyday accounting processes and help your business run more smoothly and efficiently.

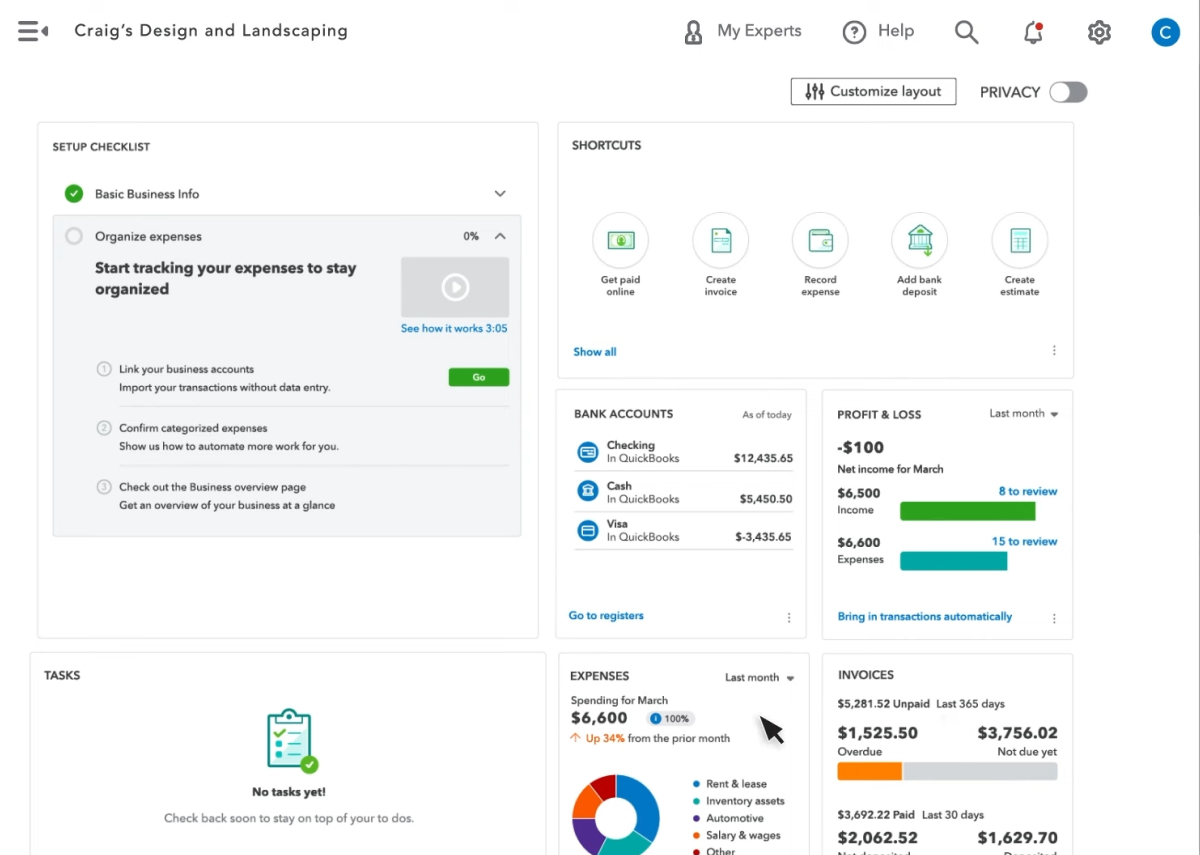

QuickBooks Online is a cloud-based platform that gives you real-time access to your finances from any device – no installations or manual updates needed.

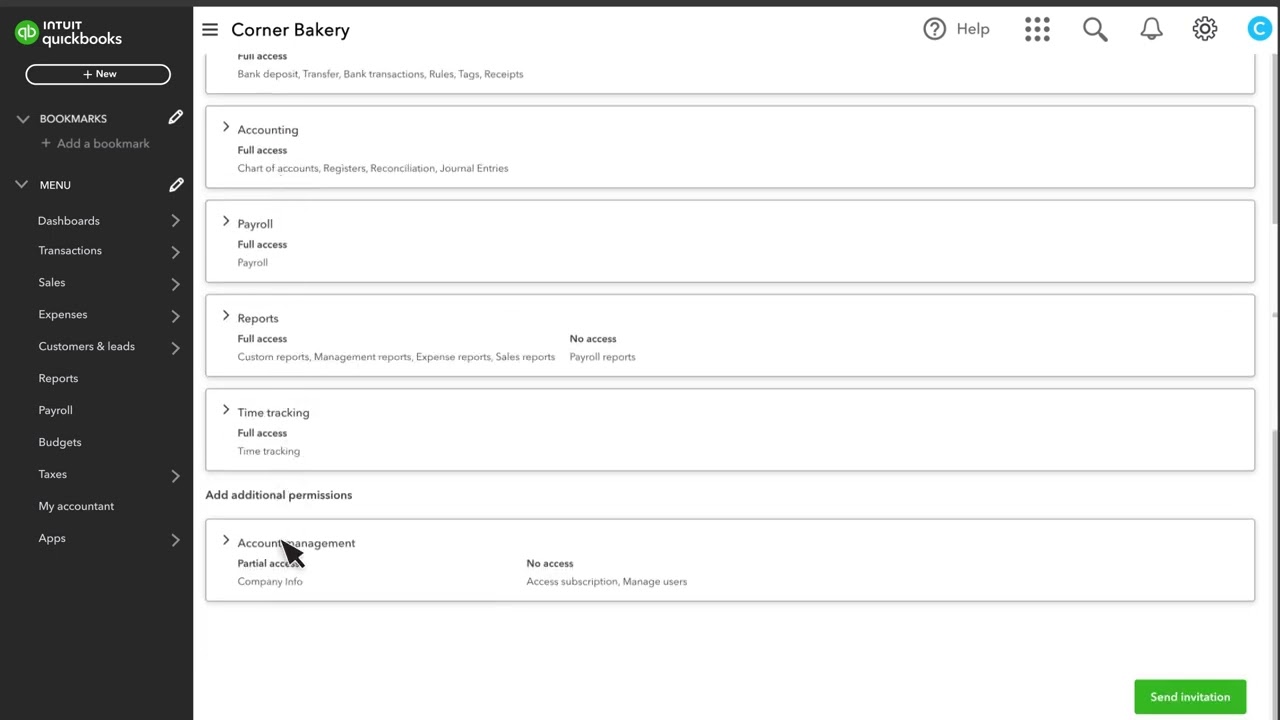

Add your team or accountant with custom permissions and collaborate live within your books, with full transparency via built-in change tracking.

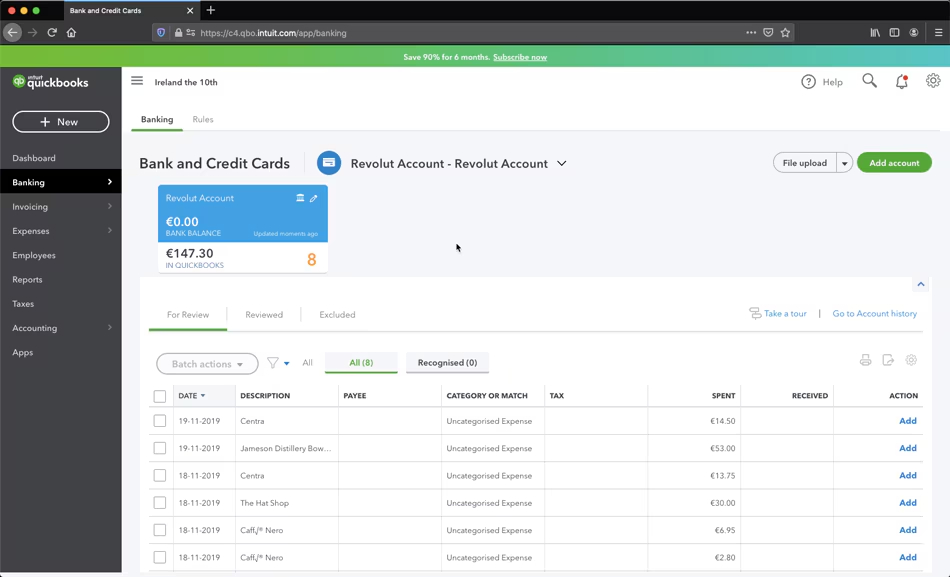

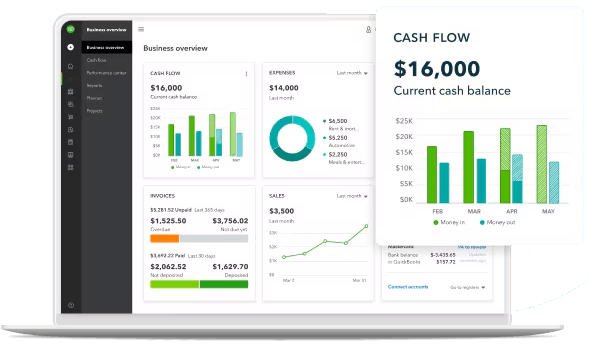

Connect bank accounts to import transactions automatically, using smart categorization and bank rules to simplify reconciliations and reduce the manual work.

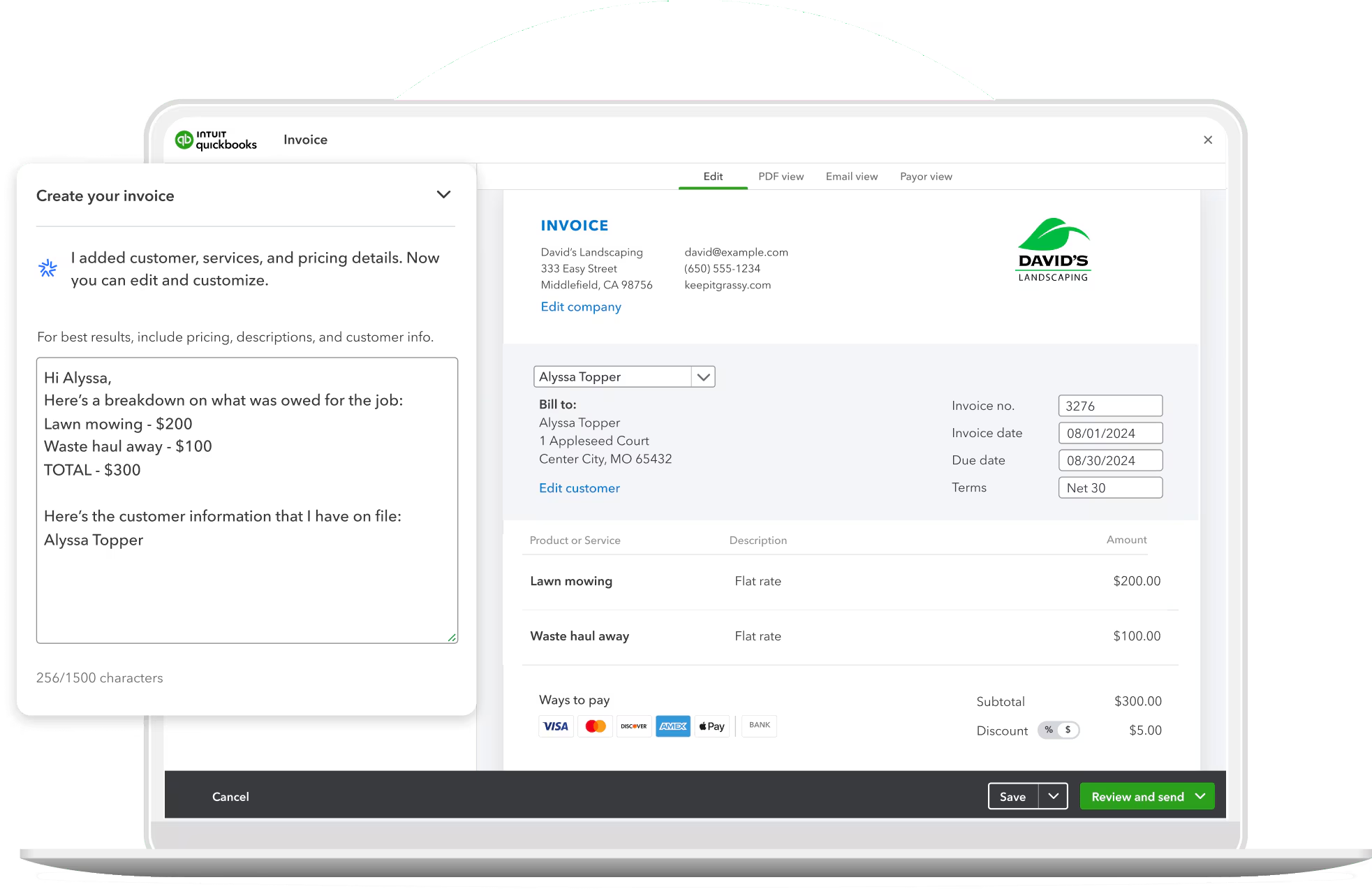

Create custom-branded invoices and accept payments online by setting recurring invoices or reminders to speed up billing and improve your cash flow.

Snap receipts via mobile, auto-import transactions, and easily categorize expenses. Also, effectively track due dates and simplify tax deductions with custom rules.

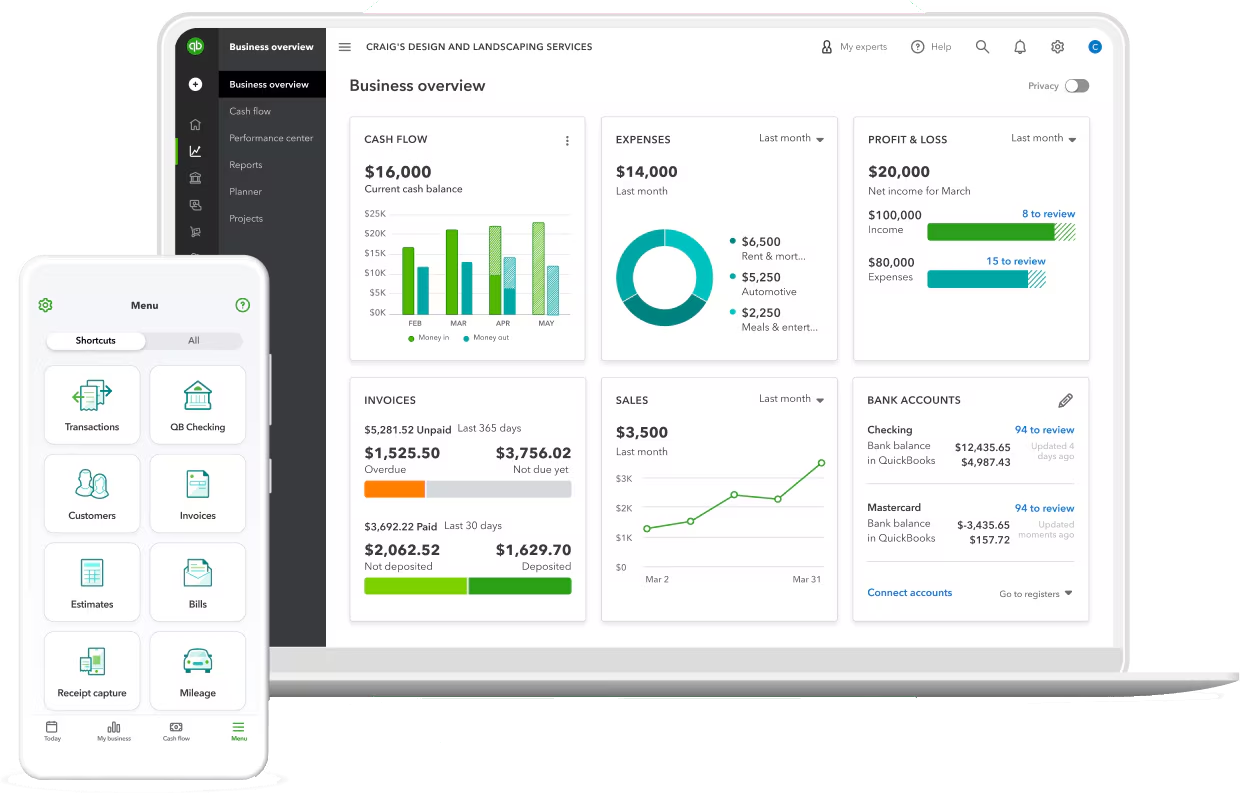

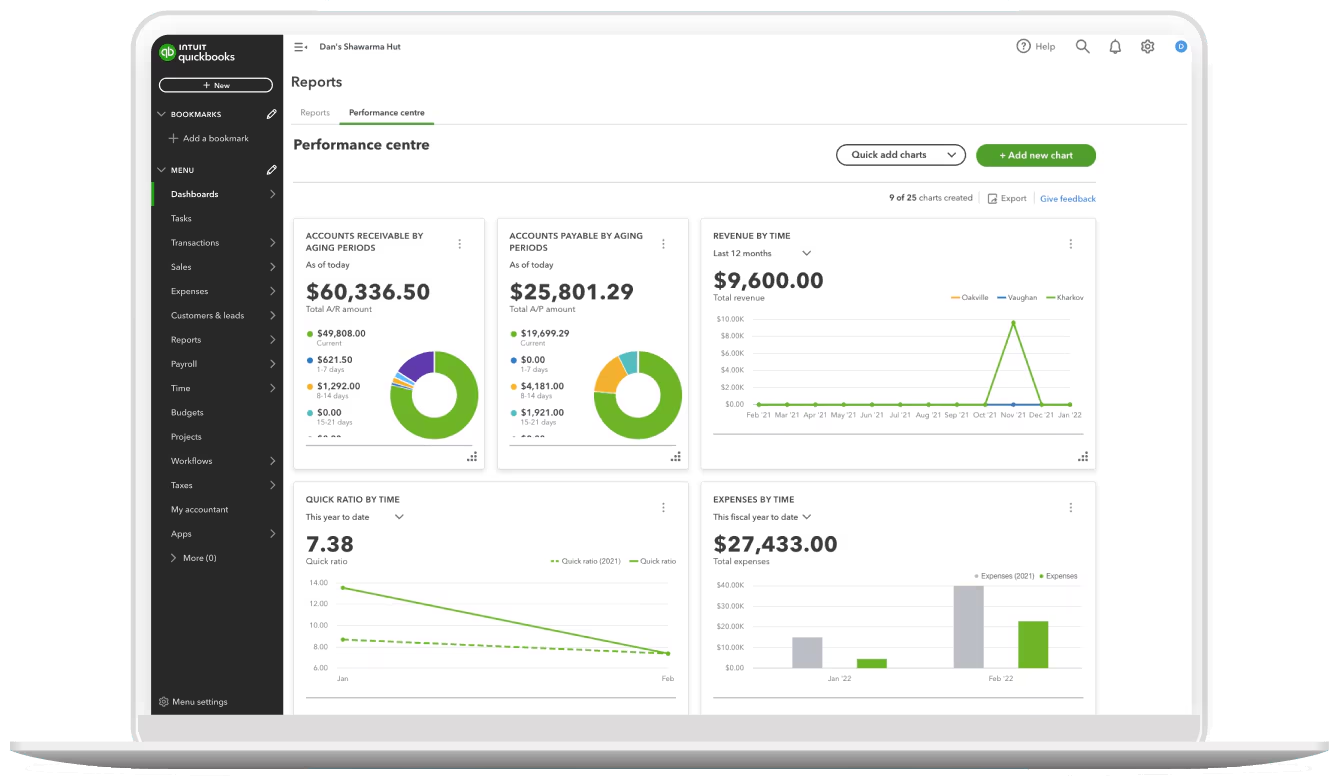

Generate real-time reports like Profit & Loss, Balance Sheet, or Cash Flow, and customize by project, customer, or location to make better finance decisions.

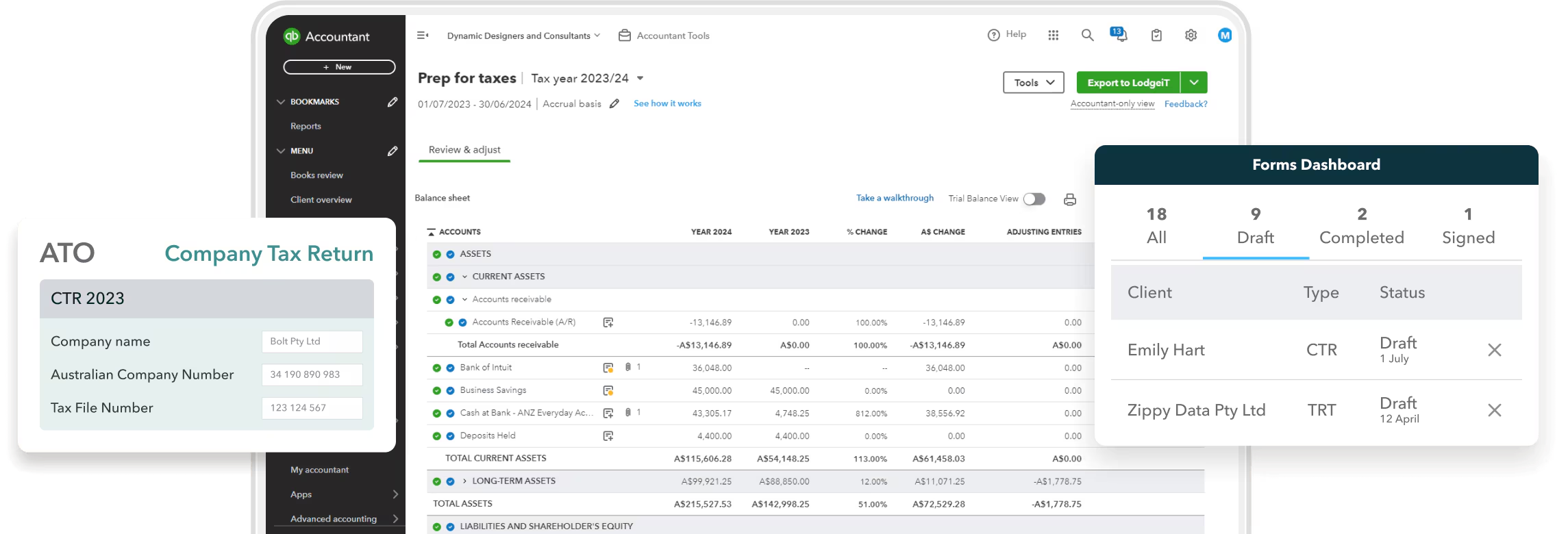

QuickBooks calculates your sales tax based on location and keeps your records audit-ready, while allowing you to export summaries directly to your accountant and stay on top of deadlines.

As your business grows, QuickBooks Online can easily be extended and adapted to meet more advanced operational and financial requirements.

QuickBooks gave this dentist the confidence to run her practice, manage growth, and stay financially connected, anytime, anywhere.

QuickBooks was amazing. It was easy to use. It was seamless. QuickBooks allows me to be able to see my practice … from anywhere. … QuickBooks integrates with our systems to be able to give me a daily snapshot of the health of our practice so I can focus on the health of our patients.

QuickBooks is a well-known option for small and mid-sized businesses looking for reliability, simplicity, and solid accounting fundamentals.

Get a quick tour of QuickBooks Online—dashboards, bank feeds, invoicing, reports, payroll, and more.

We’re proud to support the teams behind these logos. Long-term partnerships built on trust, capability, and results that hold up.

QuickBooks suits small, service-based businesses, especially where finance roles are evolving and systems need to keep up. TydeCo™ helps extend the setup.

Explore our latest thinking on financial systems, reporting strategy, and digital transformation—tailored to the industries and tools we support.

Just getting started or fine-tuning your setup?

Here are a few questions that often come up along the way.

QuickBooks Online is the perfect accounting system for service-based businesses, small retailers, e-commerce stores, nonprofits, as well as single business owners and businesses on an upward trajectory. It supports a range of functions, including recurring invoicing, payroll, and ongoing expensive management. We ensure you optimize the system’s features, from project tracking to financial performance management.

Yes, QuickBooks Online supports basic multi-currency functions for accurate billing and reporting and manages the transition process when you migrate from legacy systems to modern, robust platforms, like Sage Intacct. Note that multi-entity consolidation is limited, but we have special workarounds to ensure continuity and accuracy across systems.

Our approach identifies and corrects errors by implementing smart automation tools, including alerts and AI suggestions. A well-structured setup helps maintain compliance with tax and ensure best practices when it comes to maintaining financial standards. We review monthly reconciliations to ensure data is always accurate. organized, and audit-ready.

If moving off QuickBooks Online is good for your business, then we’ll ensure you have the info you need to make an informed decision. For instance, we might recommend you upgrade to Sage Intacct to benefit from its advanced financial management features. We assist with the migration process, including exporting data and team training.